What is a self-directed IRA?

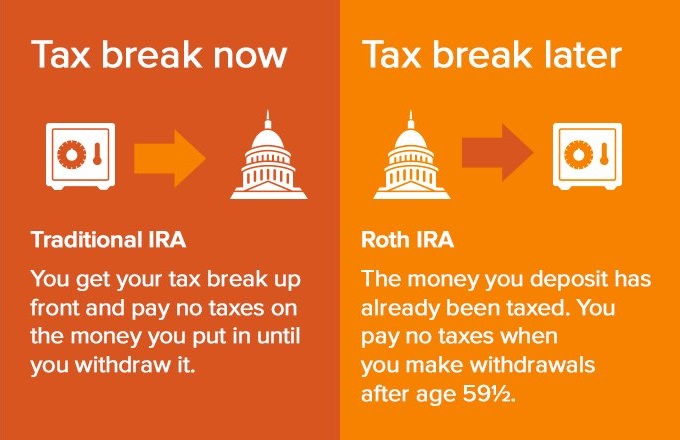

Available as either a traditional IRA (to which you make tax-deductible contributions) or a Roth IRA (from which you take tax-free distributions), self-directed IRAs are best suited for savvy investors who already understand the alternative investments and who want to diversify in a tax-advantaged account.

The main difference between Self-Direct IRAs and other IRAs is the types of investments you can hold in the account.

In general, regular IRAs are limited to common securities like:

- Stocks

- Bonds

- Certificates of deposit

- Mutual or exchange-traded funds (ETFs).

But Self-Directed IRAs allow the owner to invest in a much broader array of assets. With a Self-Directed IRA, you can hold:

- Precious metals

- Commodities

- Private placements

- Limited partnerships

- Tax lien certificates

- Crowdfunding

- Private equity investments

- Real estate and other sorts of alternative investments.

In a collaboration with Vantage, on March 11th, you will be able to learn more about Self-Directed IRAs, if it is the right vehicle for you, and also have all your questions answered in our live webinar.

More information coming soon.

TAKE CONTROL. CHOOSE YOUR OWN INVESTMENTS. SECURE YOUR OWN FUTURE

Team Localvest