How Opportunity Zones Benefit Investors

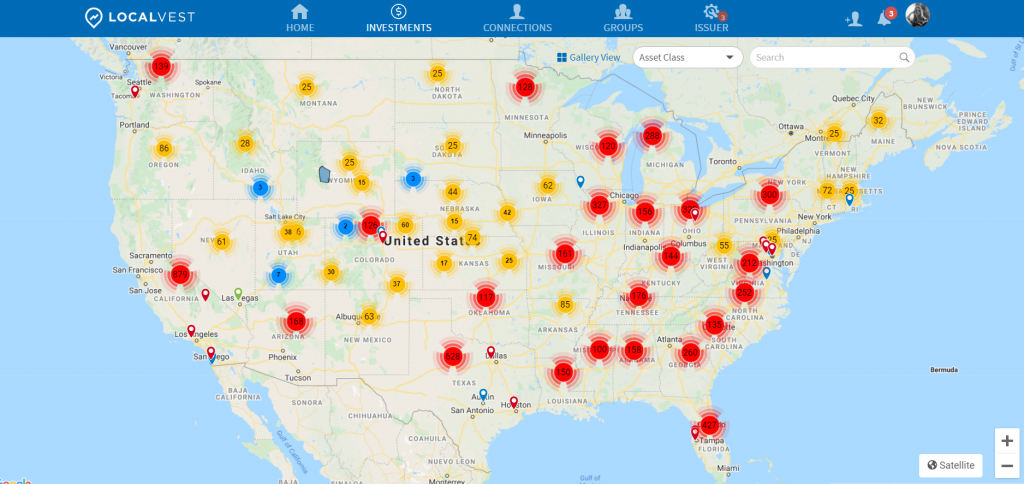

Localvest exists to connect you to like-minded individuals, resources, and expertise so you can raise capital faster, better understand investment opportunities available to you, and find investment opportunities that you care about. Today, we’re taking a closer look at Qualified Opportunity Zones (QOZs) and how they benefit investors.

UNDERSTANDING OPPORTUNITY ZONES

What are they?

Qualified Opportunity Zones (QOZs) are geographical areas of the United States which state and federal governments nominate as localities that would benefit from economic development and where preferential tax treatment is given to new investments in these areas.

When were they created?

The Tax Cuts and Jobs Act of 2017 created Opportunity Zones (OZs) and by 2018, the first OZs were designated across 18 states. OZs now cover all 50 states, the District of Columbia and five U.S. territories.

What is their purpose?

Opportunity Zones were created to stimulate economic development. Their intended purpose goes beyond job creation and unemployment reduction to include goals like increasing average wages and household income thereby contributing to positive growth and progress within communities, encompassing everything from crime and inequality reduction to improvements in education.

How Opportunity Zones Benefit Investors

Opportunity Zones provide tax incentives for investors who put new capital into businesses that operate in QOZs. Investors can both re-invest and defer federal taxes on any capital gains realized until December 31, 2026. If an investment is held for seven years, the initial deferred capital gain reduces by 15% and by 10% if held for five years. If an investment is held for 10 years, taxes on profits from the sale of an opportunity zone investment could be completely eliminated.

Key benefits for investors include:

- Significant tax advantages

- No need to live in a QOZ to invest in one

- Contributing to the growth and progress of an area you care about

- Meaningful impacts on the lives of people you care about

JOIN THE OPPORTUNITY ZONE INVESTOR GROUP ON LOCALVEST!

Interested in learning more about Qualified Opportunity Zones and how they work?

Join the Opportunity Zone Investor Group on Localvest! It’s dedicated to identifying and showcasing Opportunity Zone investments and helping investors understand them, whether you’re a seasoned expert or just getting started. They’ll provide assistance with everything from navigating regulation and compliance requirements to understanding the impact your investment can make. Register today or login into the platform and contact one of the Group’s Managers to learn more!

And for additional information on Opportunity Zones, check out the dedicated IRS webpage.