Learn how to find investors on linkedin

Did you know that 93% of B2B marketers view LinkedIn as the most effective lead generation source? If you’re fundraising under Rule 506(c), LinkedIn is not only a great tool you can use to share your deal, but it’s also a great way to identify and connect with like-minded investors.

Here are some expert tips from our Marketing Director, Laura Calazans on how to find and successfully engage with investors on LinkedIn:

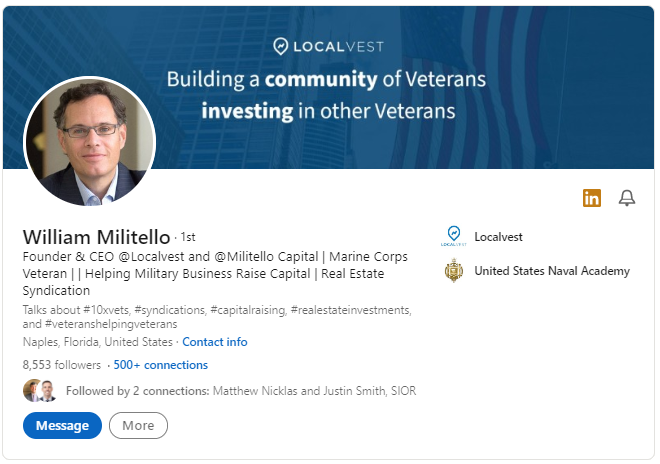

1. Create an awesome profile!

Ensure your profile’s About section is complete and up to date and includes information about your company. Use your headline to communicate your job title, but also add keywords that are relevant to your business. Update your photo with a professional headshot and use a cover photo that reflects your brand. Once you’ve updated your profile, ask a colleague to proofread it for you.

2. Stay active to be relevant

When posting on LinkedIn, use keywords and hashtags that grab the attention of your target audience. If it’s appropriate, tag individuals in your posts. Interact with your existing connections by sharing or reacting to their posts. Staying active on LinkedIn is one way to demonstrate that relationship building through networking is important to you.

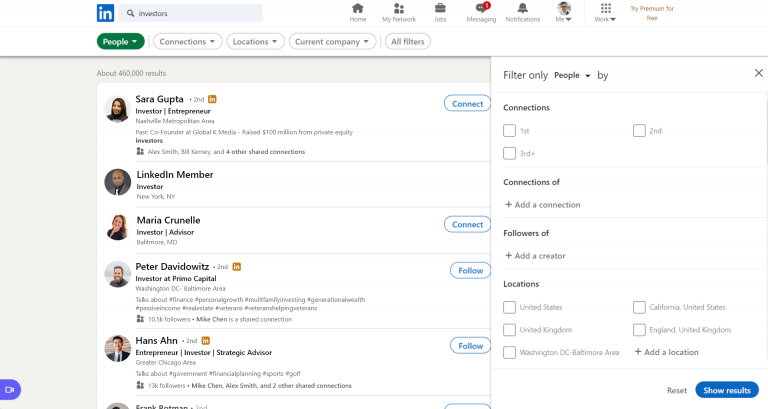

3. Maximize LinkedIn search functions

To identify potential investors, conduct a LinkedIn search. Narrow down the results using All Filters. Here, you can filter by connection type, location, industry, school and more. Using the Company filter, try typing in words such as “Investor” or “Capital” to maximize your chances of finding the right connections.

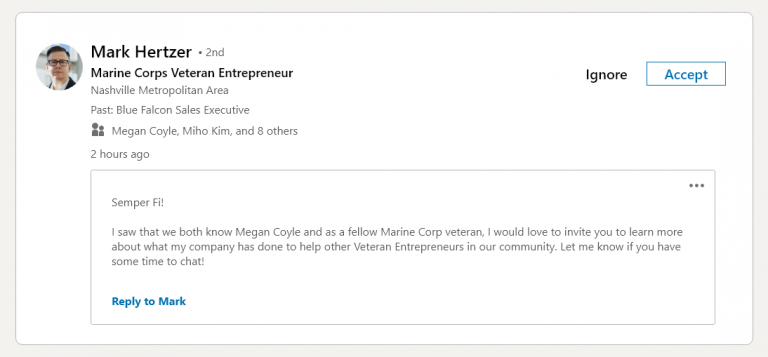

4. Reach out and connect

Once you’ve identified potential investors, start cultivating a relationship with them by following their LinkedIn pages and sending connection requests. If you share a mutual connection, ask for an introduction. Referrals are the best way to find investors because they establish your credibility and signal to an investor that you can be trusted.

5. Build trust before pitching your deal

When potential investors accept your connection requests, don’t send them your pitch deck right away. Instead, tell them why you’re happy to connect, start a conversation about the things you have in common, or ask them for 10 minutes to talk. This builds trust and demonstrates you respect their time. If they share an email address with you or directly express interest in your deal, send them your pitch deck. If your deal is on Localvest, you can also use the SmartShare™ link to share your pitch and track viewing activity.

6. Stay connected and share updates

When potential investors accept your connection requests, don’t send them your pitch deck right away. Instead, tell them why you’re happy to connect, start a conversation about the things you have in common, or ask them for 10 minutes to talk. This builds trust and demonstrates you respect their time. If they share an email address with you or directly express interest in your deal, send them your pitch deck. If your deal is on Localvest, you can also use the SmartShare™ link to share your pitch and track viewing activity.

7. Repeat and grow your investor network!

Are you ready to find investors?

Explore our website or chat with us to learn how Localvest can help you succeed.

Share: